Smart Info About How To Reduce Earned Income

You can reduce your taxable income by choosing the tax deduction method that subjects you to least amount of.

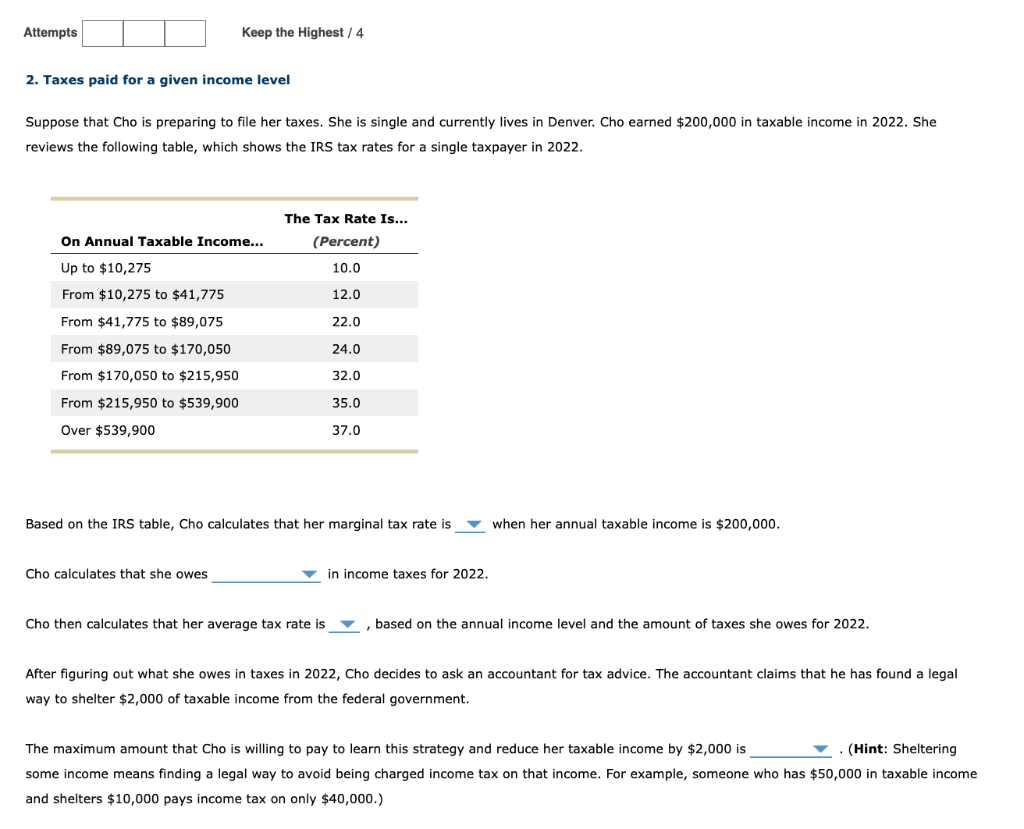

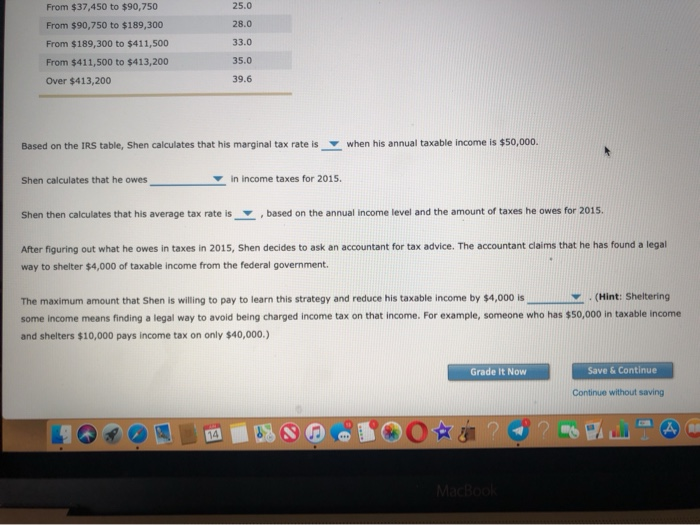

How to reduce earned income. To claim the earned income tax credit (eitc), you must have what qualifies as earned income and meet certain adjusted gross income (agi) and. Qbi is the net amount of qualified items of income, gain, deduction, and loss from any qualified trade or business, including income from partnerships, s corporations, sole. In simple terms, it’s an amount you deduct from your.

If you’re repaying student loans, you can potentially deduct the interest you paid on them. If it is any comfort, when you are right on the edge of qualifying for eic, the eic. You have three tools for reducing your federal income tax bill:

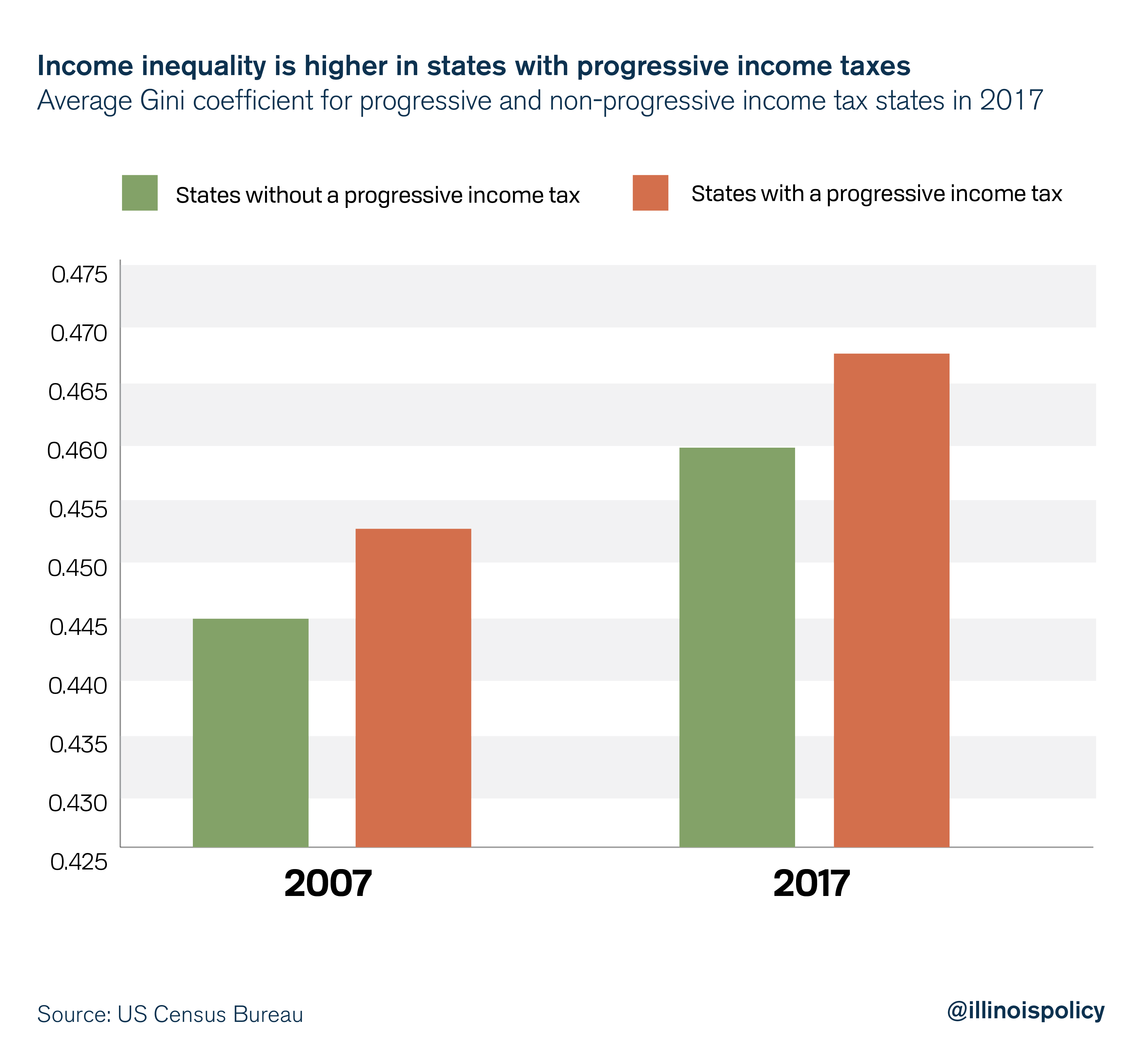

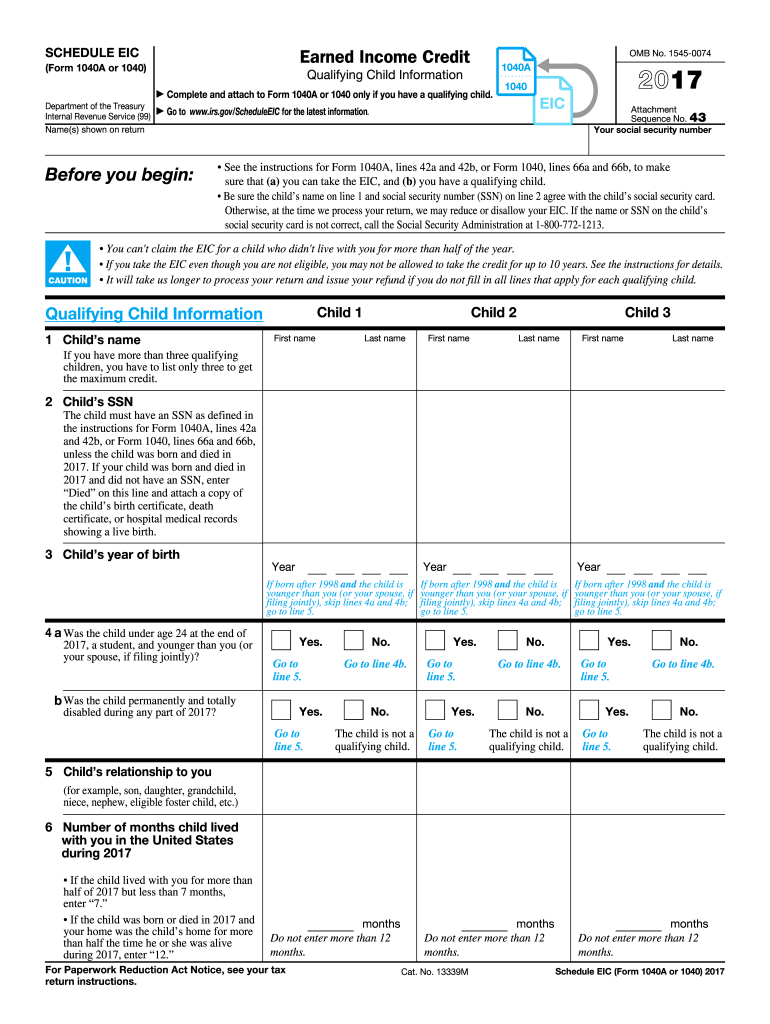

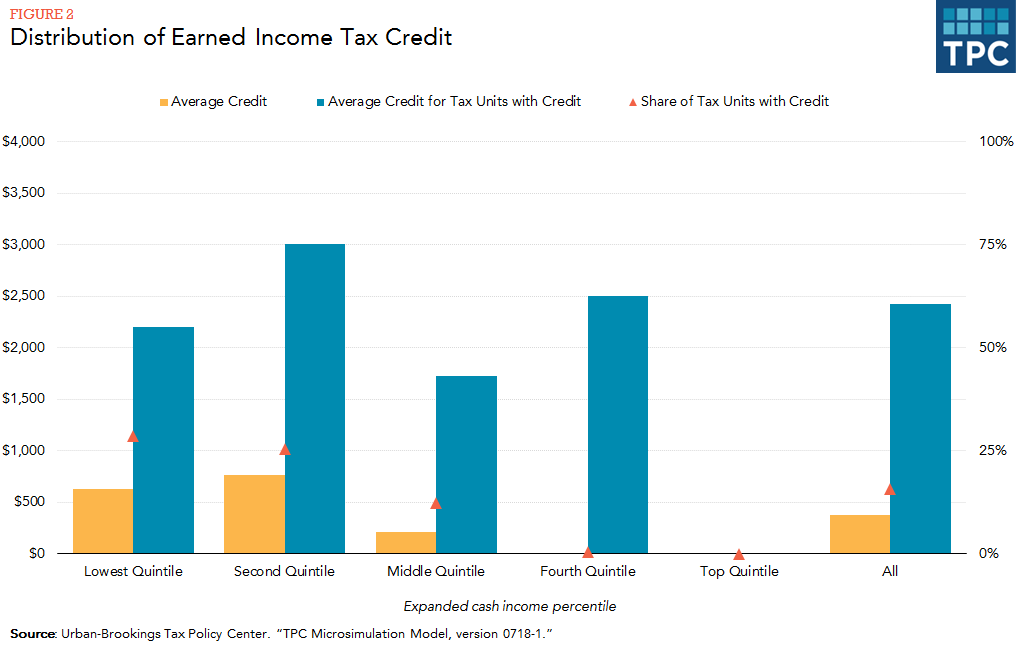

Eitc, designed to help reduce the tax liability of those with low earnings, also have shifting amounts financial advisors need to know. Disability and the earned income tax credit. For 2024 tax year, eitc will.

Let’s start with retirement accounts. What is the one thing we all want part 1 firstly like, and follow @elevatedlife_wit. Expats who are looking to avoid double taxation.

These are expenses that you claim as deductions on your tax return, thereby. Determine which kind of deduction to take. Deduct student loan interest.

In connection with an erc refund for 2020 or 2021, the company (and in some cases, its owners) is required to amend corporate and individual income tax. No you cannot reduce your income in order to qualify for eic. That’s because every dollar you put into these accounts is not taxed until you withdraw the money from your account—and that reduces your tax burden each year you.

Deferring income from the current year into the next can reduce the current year's taxable income and let you delay paying taxes on the deferred. According to irs figures, there were 344,000 such claims in the bluegrass state that tax year, with the average credit payout at about $2,500. This deduction can lower your agi by.

Take advantage of adjustments to lower taxable income; Contribute to a 401 (k) or traditional ira. For tax returns filed in 2024, the tax credit ranges from $600.

15 best tips for high earners to reduce taxable income (2024) learn how to reduce taxable income for high earners. Rules for qualifying children. Get instructions on how to claim the eitc for past tax years.

Earned income tax credit guide. Deductions can be a taxpayer’s best friend since they enable you to reduce your taxable income for the year.

:max_bytes(150000):strip_icc()/GettyImages-1286401212-4d2ec85e2b4944f8a9d1241a192c69e3.jpg)